Nachhaltige Aufforstungen in Wald. 25 Jahre Erfahrung in nachhaltigen Waldinvestments.

Luxembourg Private Equity Real Estate Luxembourg Sif And Sicar Ogier

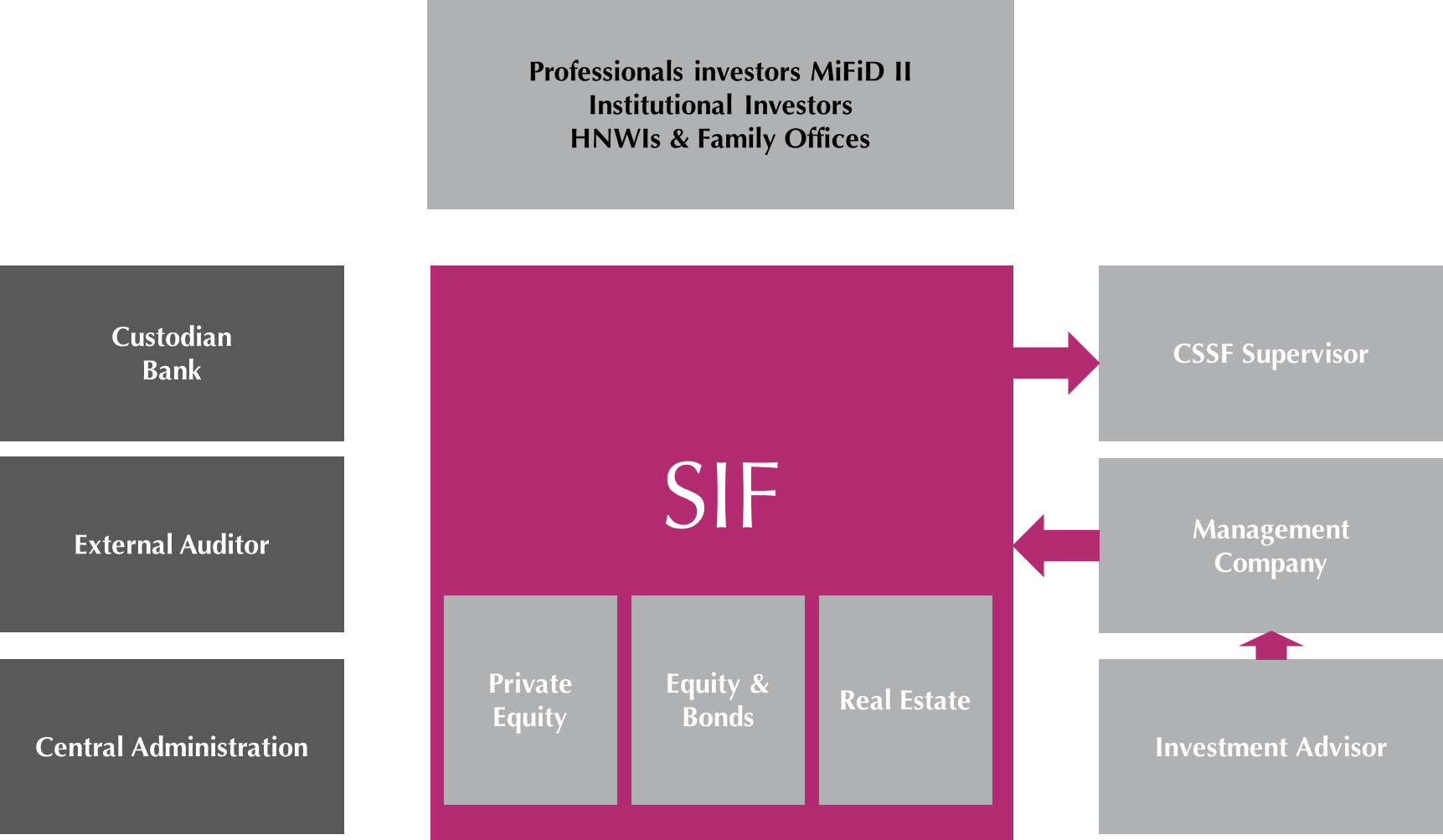

SIF Specialised Investment Funds SICAR Investment Company in Risk Capital RAIF Luxembourg Reserved Alternative Investment Fund ELTIF EuVECA.

List of investment funds in luxembourg. 200 rows 17Capital Fund 3 Luxembourg SCSp. Trends und News aus der Fondswelt. Reklamm Ökologische Aufforstung für Umwelt Klima und Artenschutz.

– 28 Strategic Investors. 412F route dEsch L-208 Luxembourg. European Long Term Investment Funds.

List of Hedge Funds in Luxembourg LU Aurigins deal sourcing platform enables hedge funds managers gain access to hundreds of screened high quality deals globally. CSSF 7 Your investment fund in Luxembourg June 2020 SIF 3905 Part II 712 SICAR 65 UCITS 4733 Other 162 Netherlands 12 Luxembourg. Welcome to the Allianz Global Investors website dedicated to Luxembourg and European professional investors.

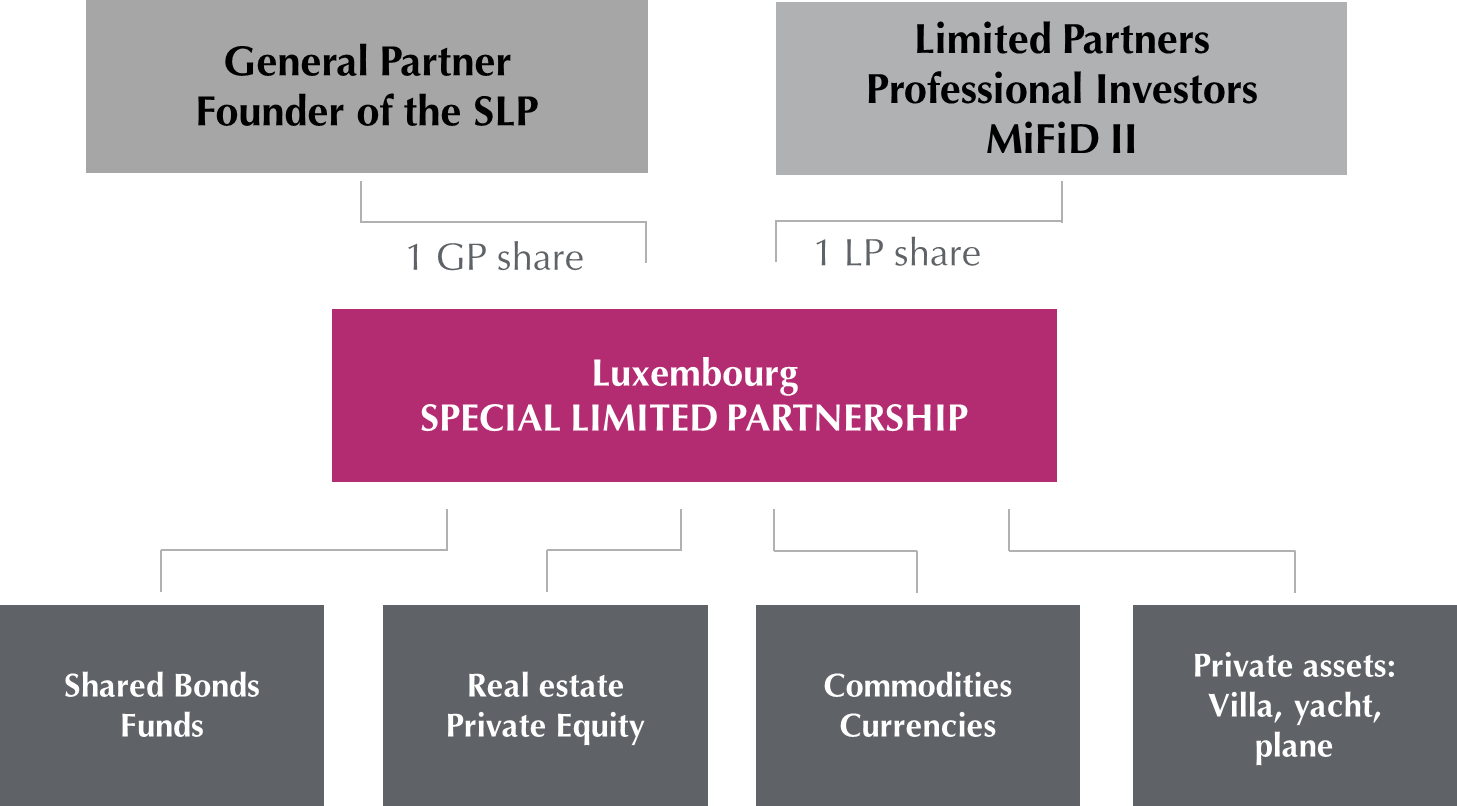

The countrys international business environment has given rise to a number of structures designed to facilitate PE and real estate. Undertakings for collective investment in transferable securities UCITS Undertakings for collective investment UCI Specialised investment funds SIF Investment companies in risk capital SICAR Securitisation undertakings. Luxembourg is a prime location for private equity and venture capital hedge funds and real estate funds.

Top Investor Types Venture Capital Private Equity Firm Accelerator Micro VC Corporate Venture Capital. Exit Options for John Hancock Bond and Corporate Finance Group. LuxSE launches Responsible Investment Index the Lux RI.

Franklin Templeton International Services Sàrl. You have connected to this site as a Professional as defined by MiFID. Among fund manager companies the largest promoterinitiator of Luxembourg.

Close soon – 500 PM 8A Rue Albert Borschette L-1246 Luxembourg Lëtzebuerg The administrator registrar and transfer agent for our Luxembourg registered funds. This year marks the listing of the Finance Union the first investment fund on LuxSE. Reaching out to an investment fund is another way to grow your company.

Investment funds taking a corporate form SA SARL SCA or Coop-SA have to open a blocked incorporation bank account with a bank in Luxembourg and have the initial share capital transferred to this bank account prior to being incorporated before a Luxembourg notary. Regulated Investment Funds by Regime and by initiators country of origine as of April 30th 2020 source. The SNCI Société Nationale de Crédit et dInvestissement and the EIF European Investment Fund have jointly established the Luxembourg Future Fund.

Luxembourg RAIF reserved alternative investment fund Luxembourg SIF specialised investment fund Luxembourg securitisation vehicles. Reverse solicitation and marketing of AIFM shares. Michael Ferguson Traditional funds.

Advised Althelia Funds part of Mirova Natural Capital an affiliate of Natixis Investment Managers on the establishment ongoing legal operations and closing of the Althelia Sustainable Ocean Fund. To continue you must have the experience and knowledge required in investment. And in the AIFM rankings Part IISIF SICARs Universal Investment Luxembourg take the first place this year ahead of Deka International with figures respectively of US310bn and US269bn followed by Cadelux in third position with US236bn.

Advised DNB Asset Management on the launch of a Luxembourg debt fund structured as a European long-term investment fund ELTIF a pan-European regime for alternative investment funds. Reklamm Autoren informieren über Eigenschaften und Unterschiede – jetzt informieren. Top Funding Types Private Equity Venture – Series Unknown Undisclosed Post-IPO Equity Series A.

With a volume of 150 million this fund invests. Investors in this hub have made investments into companies and startups with headquarters located in Luxembourg Luxembourg. Investment Funds in Luxembourg is the definitive technical guide providing an introduction to Luxembourg as a center for investment funds the types of fund vehicles available and a summary of the regulations applicable to the setting-up and operation of Luxembourg investment funds.

Luxembourg investment funds EY supports asset managers and alternative investment fund houses through the choice of fund vehicle the analysis of target markets the definition of an efficient operating model and distribution strategy and the selection of service providers.

Expertise In Investment Funds Structures In Luxembourg Investment Management

Investment Funds In Luxembourg

Funds Platform Investment Vehicles Funds In Luxembourg

Private Equity Funds In Luxembourg Solutions Advices For Firms

Alternative Investment Funds In Luxembourg Hedge Funds

Open Investment Fund In Luxembourg Sicav Spf Sif Other Funds

Hedge Funds Services In Luxembourg Reporting Advices

Comparison Table Of Luxembourg Investment Vehicles Chevalier Sciales