The AIFMD covers all alternative sectors such as hedge funds. The Luxembourg law of 12 July 2013 on alternative investment fund managers AIFM Law entered into force on 15 July 2013.

Reserved Alternative Investment Fund Raif Services Tmf Group

The country has played a pivotal role in opening up markets for international fund distribution due to its long history of creating products that enable firms to develop their businesses.

Alternative investment fund managers directive luxembourg. Alternative Investment Fund Managers Directive AIFMD The EUs AIFMD entered into force in mid-2011. Reklamm Die Zeit zum Handeln ist günstig. Directive 201161EU of the European Parliament and the European Council on alternative investment fund managers.

Investment funds which do not meet the criteria set by the EU Directives. Geld anlegen und gleichzeitig in Umwelt und soziale Verträglichkeit investieren. Regulating the AIF managers.

Luxembourg implementation ALFI thanks Arendt Medernach which produced the content of this brochure for its authorisation to reprint. The objective of this module is to provide the participants with a solid understanding of the Alternative Investment Fund Managers Directive. Reklamm Gain Perspectives from the Largest Asia Focused Investment Firm in the US.

Luxembourg act of 12 July 2013 on alternative investment managers as amended the AIFM Act transposed Directive 201161EU on Alternative Investment Fund Managers AIFMD into Luxembourg law. The first Chapter highlights the key features of the Directive. 1988 including the European Unions Alternative Investment Fund Managers Directive AIFMD.

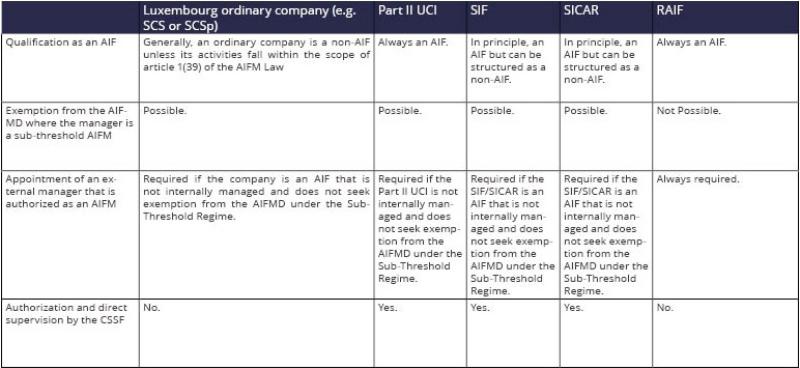

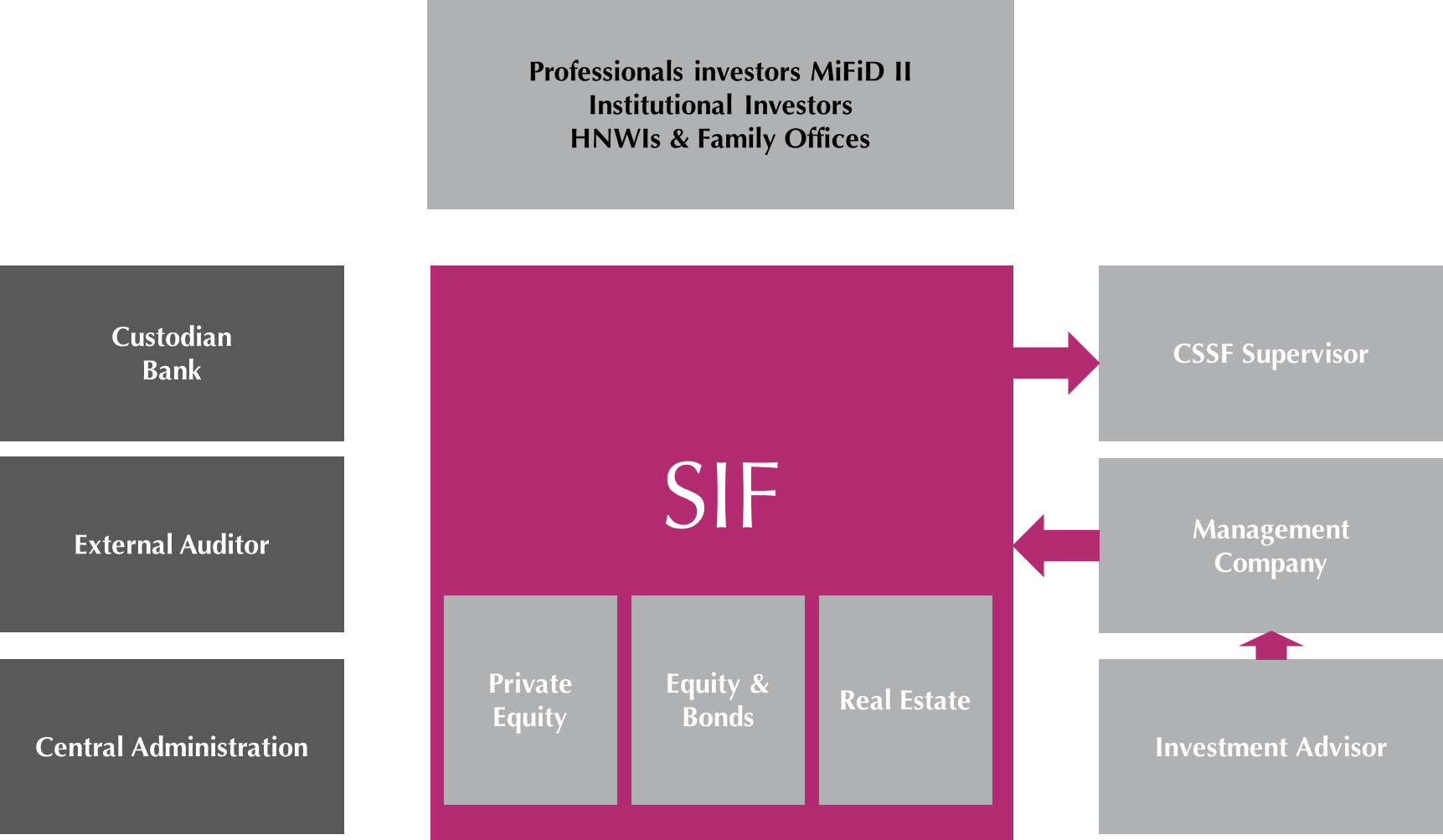

This includes the Luxembourg specialized investment funds SIF governed by the Luxembourg law of 13 February 2007 and the Luxembourg investment. Hedge funds private equity fund venture capital fund real estate fund infrastructure fund distressed debt fund microfinance fund socially responsible investment fund tangible assets fund and any other type of alternative funds. Rapid implementation of the Directive has helped Luxembourg to further develop its role as a well-regulated hub for the global alternative investment.

12 Rue Erasme L-1468 Luxembourg. The first category covers the managers of AIFs and consists principally in the law dated 12 July 2013 AIFM Law which transposes the alternative investment fund managers directive 201161EU AIFMD into Luxembourg. Directive 201161EU of the European Parliament and of the Council of 8 June 2011 on Alternative Investment Fund Managers and amending Directives.

On 1 July 2011. This brochure focuses on the Alternative Investment Fund Managers Directive with special attention given to third countries. Asia May Complement Your Portfolio.

It is designed to protect investors and regulate hedge funds private equity real estate funds and other Alternative Investment Fund Managers AIFMs. The alternative investment fund managers directive. A 2016 No 39 the Law of 10 May 2016.

AIFMs are governed by the Law of 12 July 2013 on alternative investment fund managers. Arendt Medernach in Luxembourg. Article 1 39 of the AIFM Act defines an alternative investment fund AIF as a collective investment.

An Alternative Investment Fund Manager AIFM is any legal person whose regular business is managing one or more alternative investment funds AIFs. The second Chapter illustrates through practical case studies the implications of the Directive on. The objective of this module is to provide the participants with a solid understanding of the Alternative Investment Fund Managers Directive.

The Alternative Investment Fund Managers Directive 201161 AIFMD is the main regulatory framework for non-retail fund managers operating in the European Union. The Alternative Investment Fund Manager Directive between other regulations and new opportunities. Egal ob Einsteiger am Markt oder erfahrener Trader.

Asia May Complement Your Portfolio. Alternative Investment Fund Managers Directive AIFMD Alternative Investment Fund Managers Directive AIFMD Published 02112020. Reklamm Gain Perspectives from the Largest Asia Focused Investment Firm in the US.

The Alternative Investment Fund Managers Directive AIFMD was published in the Official Journal of the European Union on 1 July 2011 and each EU Member State had until 22 July 2013 to implement the Directive. AIFMD Objective The AIFMD aims to create a harmonised regulation framework for alternative funds. The alternative investment funds under AIFMD cover all the main investment funds other than UCITS.

The Alternative Investment Fund Manager AIF refers to the entity that is entitled to manage the assets and the investment schemes of alternative investment funds AIFsIn Luxembourg the AIFM Law entered into force on 15th of July 2013 as a transposition of the European Unions Alternative Investment Fund Manager Directive. It imposes licensing requirements on fund managers and a broad range of regulatory requirements including capital requirements conduct of business rules and restrictions on the ability to market non-retail funds to EU investors. The Alternative Investment Fund Managers Directive AIFMD which grants a European passport to the managers of alternative funds came into effect in 2013.

Transposing Directive 201491EU of the European Parliament and of the Council of 23 July 2014 amending Directive. The Law of 12 July 2013 on alternative investment fund managers as amended.

Taking Stock Of The Alternative Investment Fund Managers Directive Nine Years Later Investment Management Deloitte Luxembourg Performance Magazine

The Luxembourg Reserved Alternative Investment Fund A Change Maker For Aifs

In Focus Luxembourg S Reserved Alternative Investment Fund Paperjam News

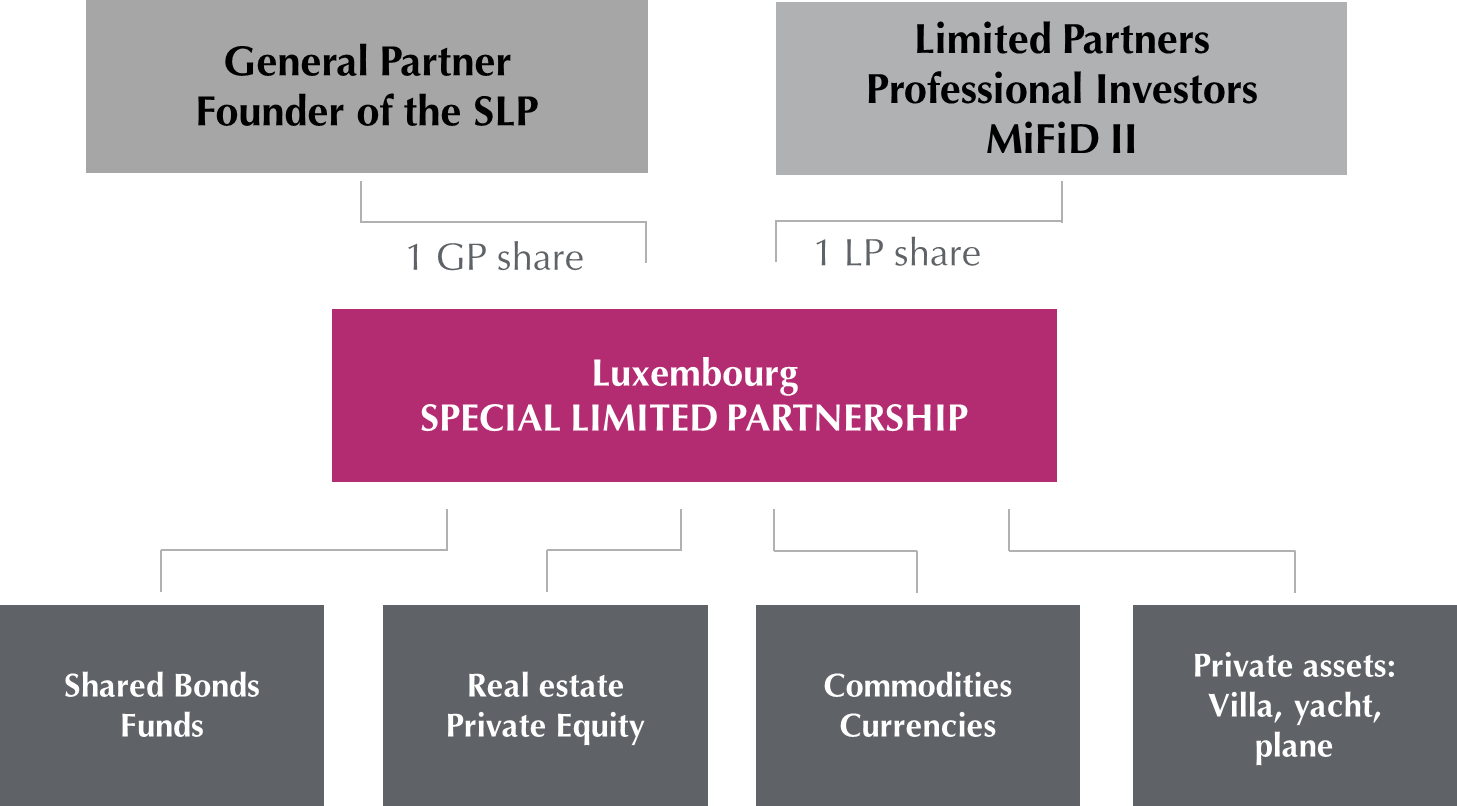

Special Limited Partnership Slp As An Alternative Investment Fund

Alternative Investment Funds In Luxembourg Hedge Funds

Book Launch Prof Zetzsche The Alternative Investment Fund Managers Directive 3rd Edition

Https Www Alfi Lu Getattachment 202e810c 60b8 4b11 B81c Cc11196e7798 App Data Import Alfi Risk Management Under Aifmd Pdf

In Focus Luxembourg S Reserved Alternative Investment Fund Ocorian