Our range of services. Creatrust Fund Fund administrator in Luxembourg A fund administrator is responsible for providing Central Administration services to an Investment Fund.

Aifm Services Royalton Partners

As further detailed by ECJ decisions and Circulars from the Luxembourg VAT administration this exemption covers administrative services outsourced to third-party providers to the extent they are specific to and essential for the management of the funds.

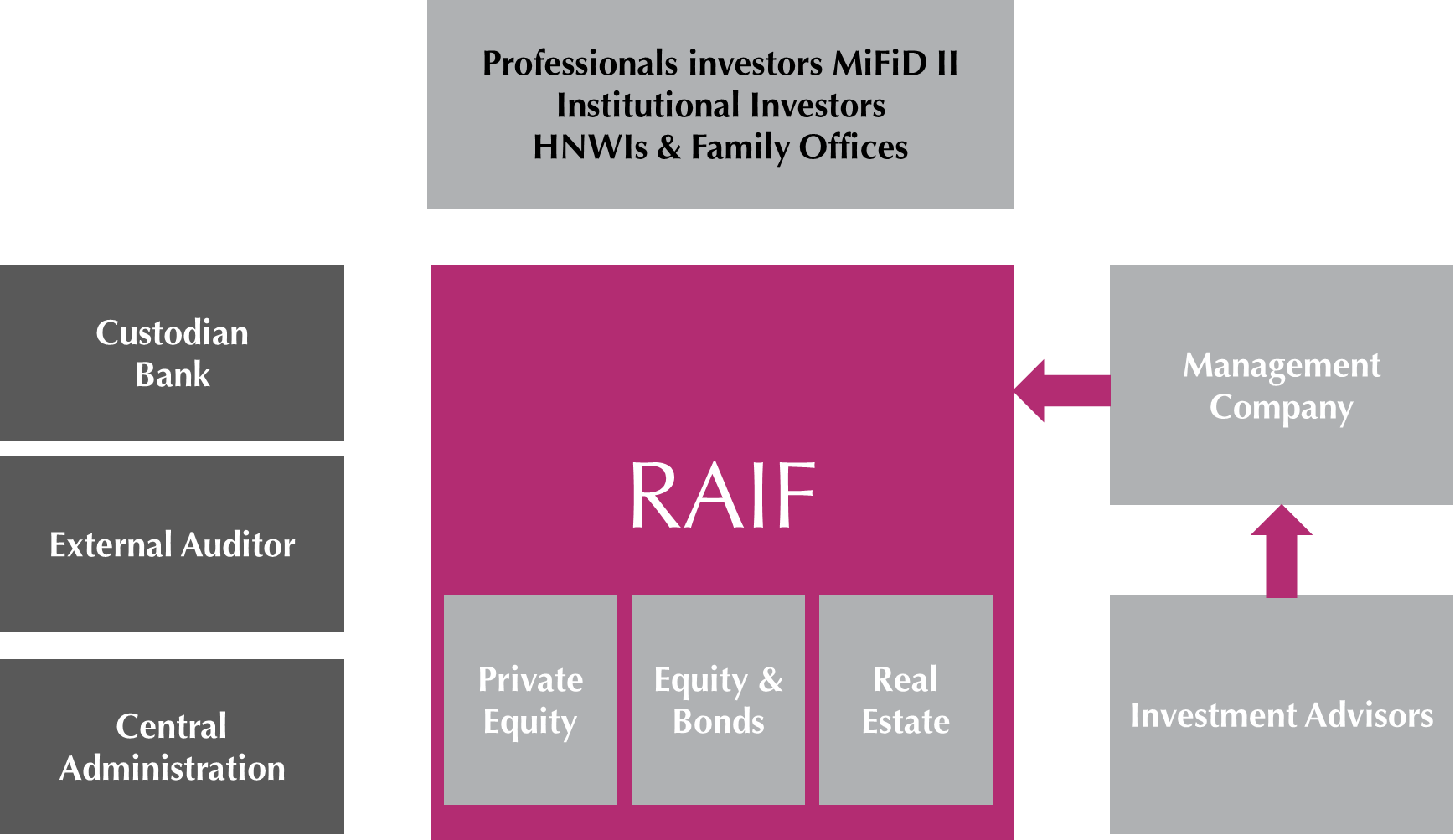

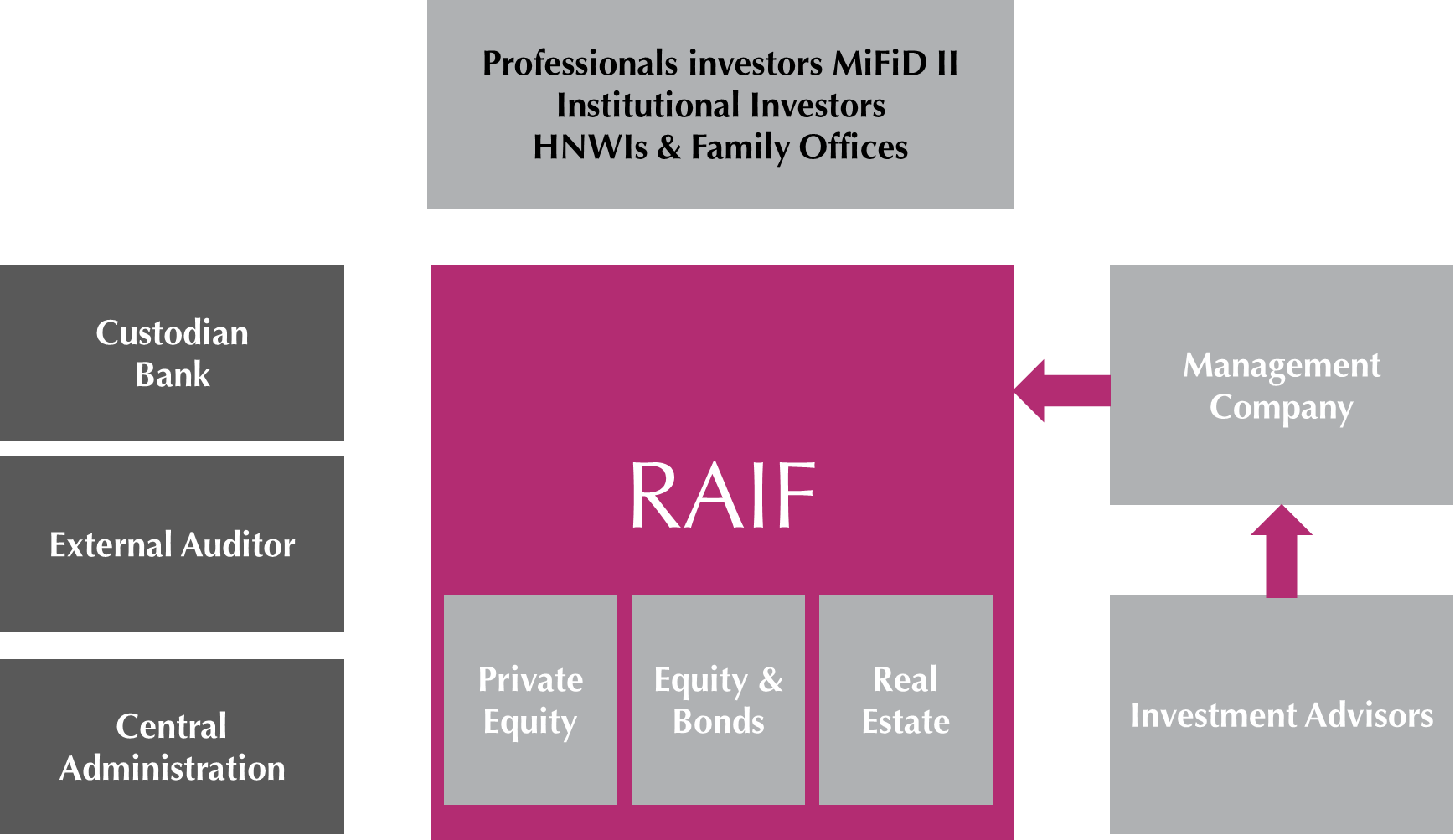

Administration services in a raif fund in luxembourg. Luxembourg RAIF sub funds are very affordable to set up and operate. Flexibility from which CSSF approved and supervised Luxembourg funds benefit. The RAIF will appoint a central administration located in Luxembourg which will perform all the duties of domiciliary administrative.

On 27 November the Luxembourg Government adopted a new draft law for the purpose of creating a new type of alternative investment fund in Luxembourg. TMF Group was the first fund services provider to support the Luxembourg Reserved Alternative Investment Fund and can assist throughout the full RAIF lifecycle. Luxembourg RAIF sub funds.

This new status of AIFs is not subject to the prior agreement and the supervision of the Luxembourg supervisory authority the CSSF but benefits from the same flexibility proposed by SIFs Specialised Investment Funds. Other services supplied to Luxembourg AIFs could potentially trigger VAT and require the VAT registration of the AIF in Luxembourg so as to self-assess the VAT regarded as due in Luxembourg. The AIFM may be established in Luxembourg.

Jetzt beim Ausgabeaufschlag sparen. It independently calculates the net asset value of the fund and its function also includes the preparation of reports accounting measurement of the funds performance and the administration. 34 The RAIFs central administration must be performed in Luxembourg.

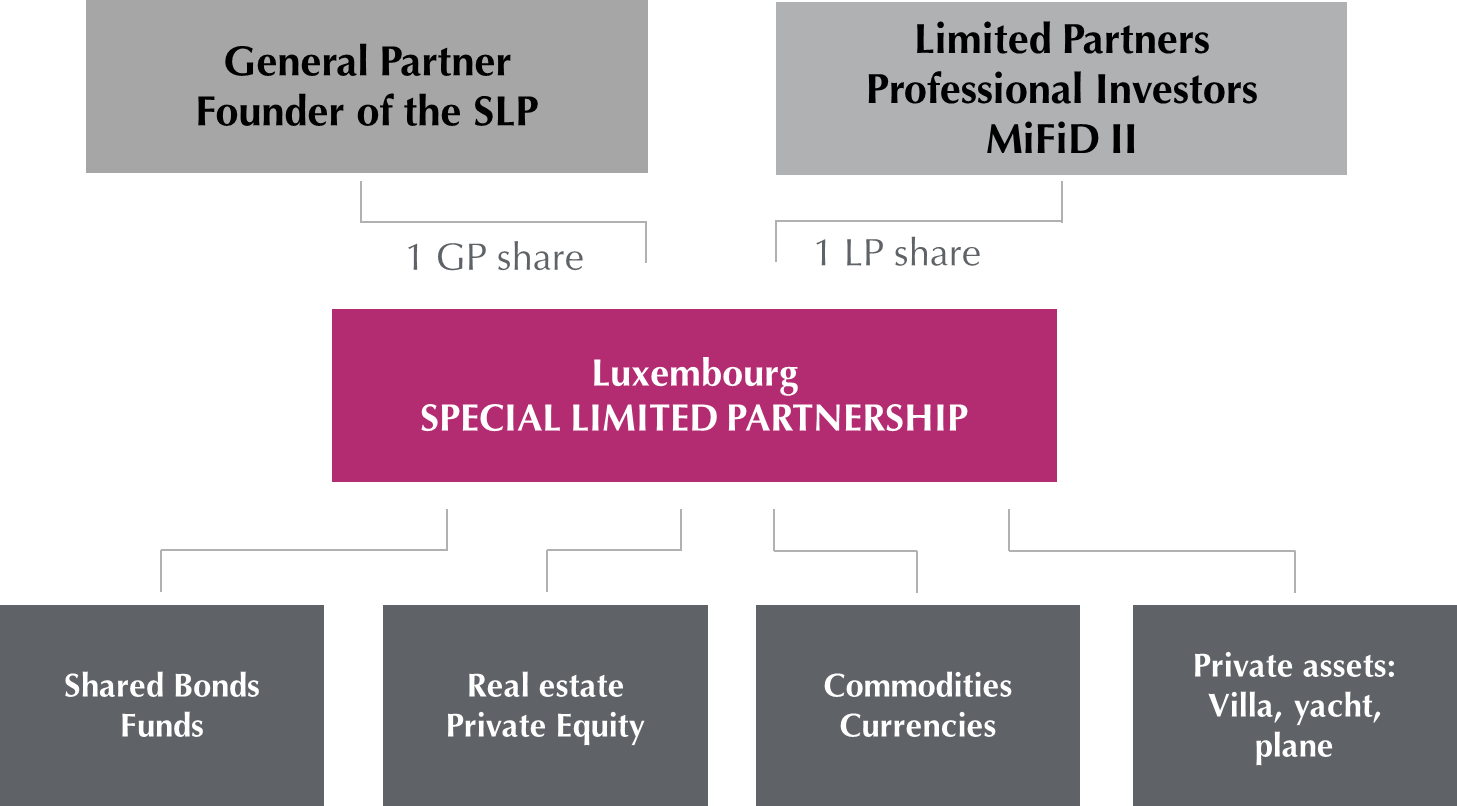

This new vehicle will widen the scope of the different options for structucting Private Equity Real Estate or Hedge Funds. Investment funds entered into force on 31 August 2016. However it is not required to have employees or premises in Luxembourg.

An authorised AIFM can manage a RAIF. A RAIF must appoint a Luxembourg depositary which is among other things responsible for the. TMF Fund Services Luxembourg SA.

This makes the Reserved Alternative Investment Fund. Must appoint a Luxembourg depositary for the safekeeping of assets. 35 Subject to the AIFM delegation rules one or several investment managers or investment advisers may be appointed by the external AIFM for the management of the RAIFs assets or one or more sub-funds.

The central administration of a RAIF must be in Luxembourg. The RAIF Law creates a new type of unregulated fund which has many of the features of the regulated specialised investment fund SIF or the investment company in risk capital SICAR but which will not be subject to the supervision of the local Luxembourg. Investment situated in Luxembourg.

The administration of a RAIF must be in Luxembourg. Luxembourg has a strong reputation as an international fund centre and caters to all types of collective investment vehicles covering all of the primary fund strategies. Production of all offering documents establishment of fund companies and coordination of the issuing process.

Accounting and administration of. A which qualify as alternative investment funds under the amended Law of 12 July 2013 on alternative investment fund managers and. The Reserved Alternative Investment Fund RAIF Fonds dInvestissements Alternatifs Réservés.

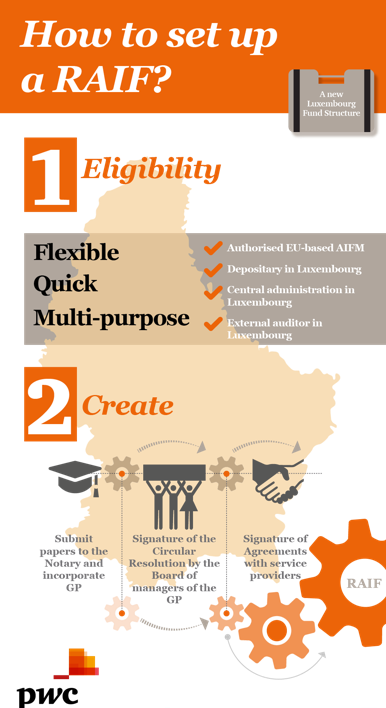

Central Administration The central administration must be located in Luxembourg. Provides the full range of services required for an alternative investment asset manager to operate a RAIF. In order to be eligible for this new regime the RAIF has to be an AIF managed by an authorised AIFM both within the meaning of the AIFMD.

The Reserved Alternative Investment Fund RAIF is the new alternative Investment Fund proposed by Luxembourg. Reklamm Fonds-Depot mit Maximal-Rabatt-Garantie. B the sole object of which is the collective investment of their funds.

The Reserved Alternative Investment Fund RAIF regime will significantly widen the options for Private Equity Real Estate or Hedge Funds. Prepare the start of the Fund operations with the depositary the AIFM and the central administration Create a RAIF Now that youve checked if you are eligible appointed the compulsory service providers and collected your documents a Luxembourg notary public will have to witness the creation of a RAIF.

Reserved Alternative Investment Fund Raif Services Tmf Group

Fund Services In Luxembourg Tmf Group

How To Set Up A Reserved Alternative Investment Fund Raif The Blog

Creatrust Raif Luxembourg Reserved Alternative Investment Fund

Insight Fund Management Services In The Focus Of Luxembourg Transfer Pricing

Management Company Services Global Advisory Administration Family Office Firm Maitland Group

Reserved Alternative Investment Fund Raif

Private Equity Funds In Luxembourg Solutions Advices For Firms