Moreover companies subject to subscription tax are required to inform until 30 June 2017 the Luxembourg indirect tax authorities. As from the tax year 2017 Luxembourg companies will have the obligation to file their CIT MBT and NWT returns electronically.

Https Impotsdirects Public Lu Dam Assets Fr Conventions Mli Unitedarabemirates Mli En Pdf

The 2017 Luxembourg tax reform.

Administration asking for 2017 taxes case law luxembourg. On 16 May 2017 the Court of Justice of the European Union ECJ delivered its long- awaited judgment in the Berlioz case regarding the. The 2017 Luxembourg tax reform. Luxembourg Tax alert – Issue 2016-32 SHARE Luxembourg 2017 tax reform passed On 14 December 2016 the Luxembourg parliament approved the.

Assets under Administration as of 30 June 2021 Read more. Late filing of the direct.

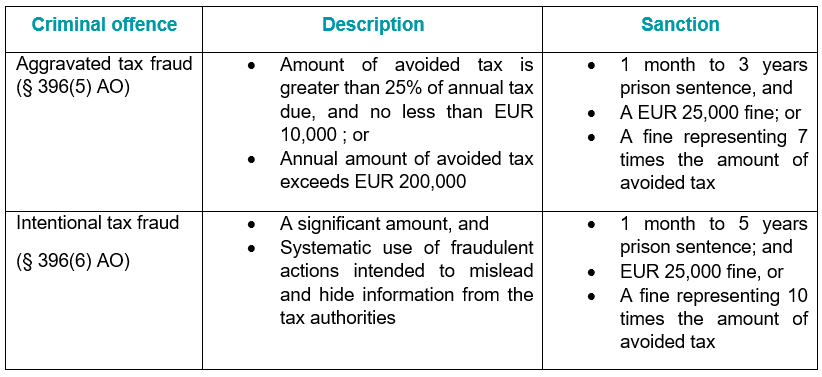

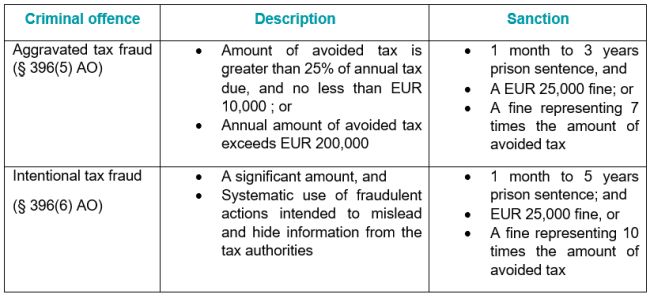

Bsp Luxembourg Tax Administration Publishes Guidance On The Application Of Administrative And Criminal Fines For Tax Fraud

Bsp Luxembourg Tax Administration Publishes Guidance On The Application Of Administrative And Criminal Fines For Tax Fraud

Luxembourg Tax Administration Publishes Guidance On The Application Of Administrative And Criminal Fines For Tax Fraud Tax Luxembourg

Https Www Ficel Lu Wp Content Uploads 2018 01 Ficel Lettre Dinformations Aux Clients English Pdf

Tax In Luxembourg Implications For Dual Citizenship

It S Time For The Tax Return Spuerkeess

Luxembourg Tax Social Security Rules That Apply To Directors Remuneration Ila Institut Luxembourgeois Des Administrateurs

European Court Of Justice Tpcases Com