Where the distance is greater than 4 distance units the deductible flat allowance is EUR 99 per distance unit up to a maximum of EUR 2574 EUR. Under specific conditions insurance premiums paid within the context of a private pension scheme qualifying under Luxembourg tax law.

How To Prepare The Luxembourg Tax Return Questions Answers Lpg Fiduciary Luxembourg

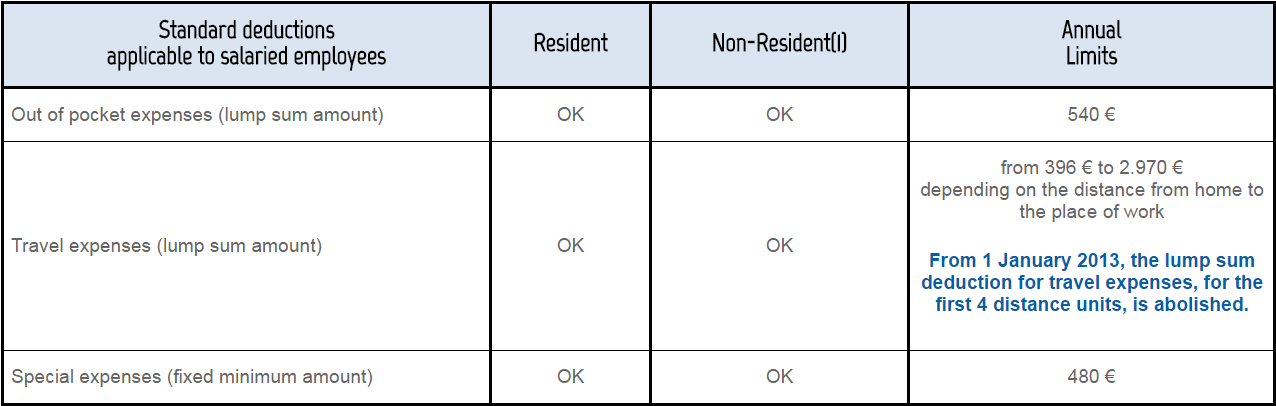

From 396 to 2970 depending on the distance from home to the place of work.

2020 tax deduction transportation distance luxembourg. Pour calculer les frais de déplacement forfaitaires léloignement se mesure en unités déloignement à 99 par an exprimant les distances kilométriques. A deduction for commuting costs is available depending on the distance between the taxpayers home and work if the distance is greater than 4km. From 1 January 2013 the lump sum deduction for travel.

Axa Luxembourg My Taxes How Much Can I Deduct

Fiscal Axa Assurances Luxembourg Kirchberg Easynext

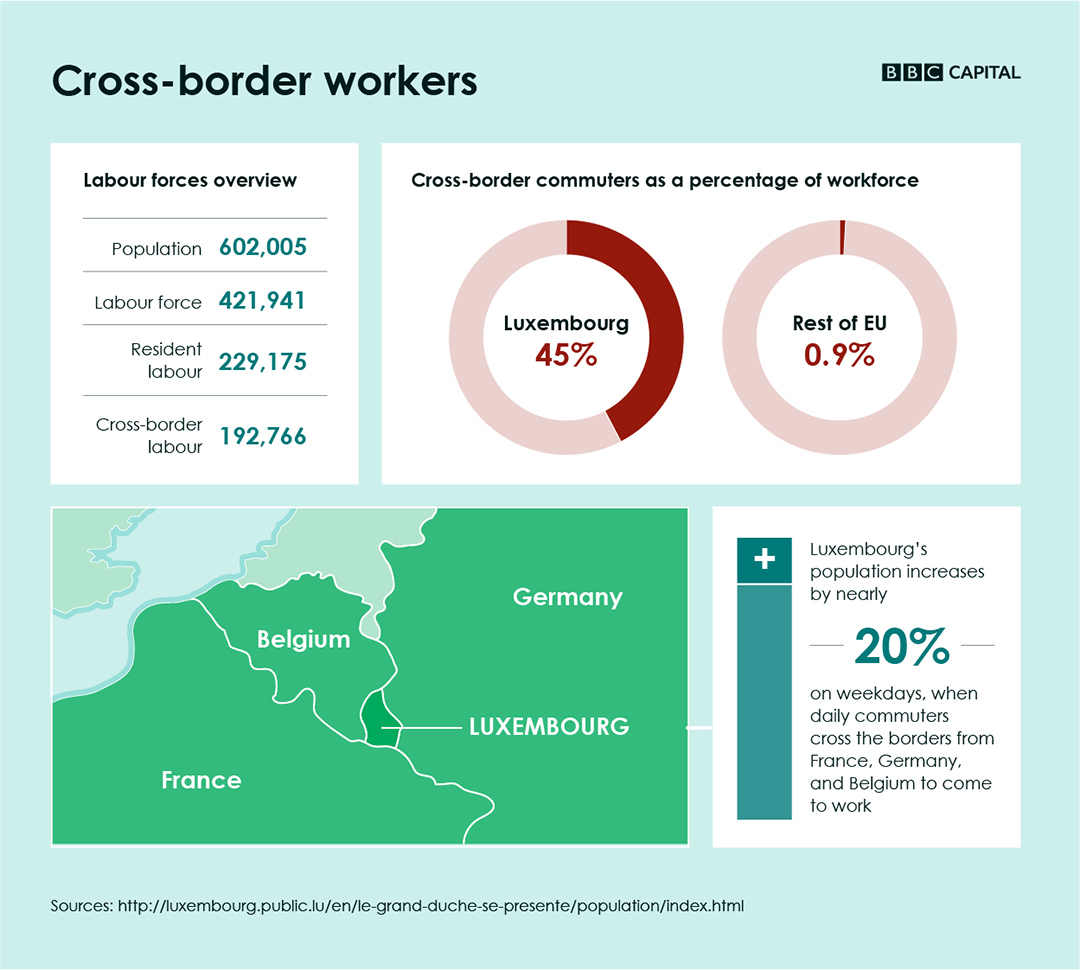

The Cost Of Luxembourg S Free Public Transport Plan Bbc Worklife

The Cost Of Luxembourg S Free Public Transport Plan Bbc Worklife

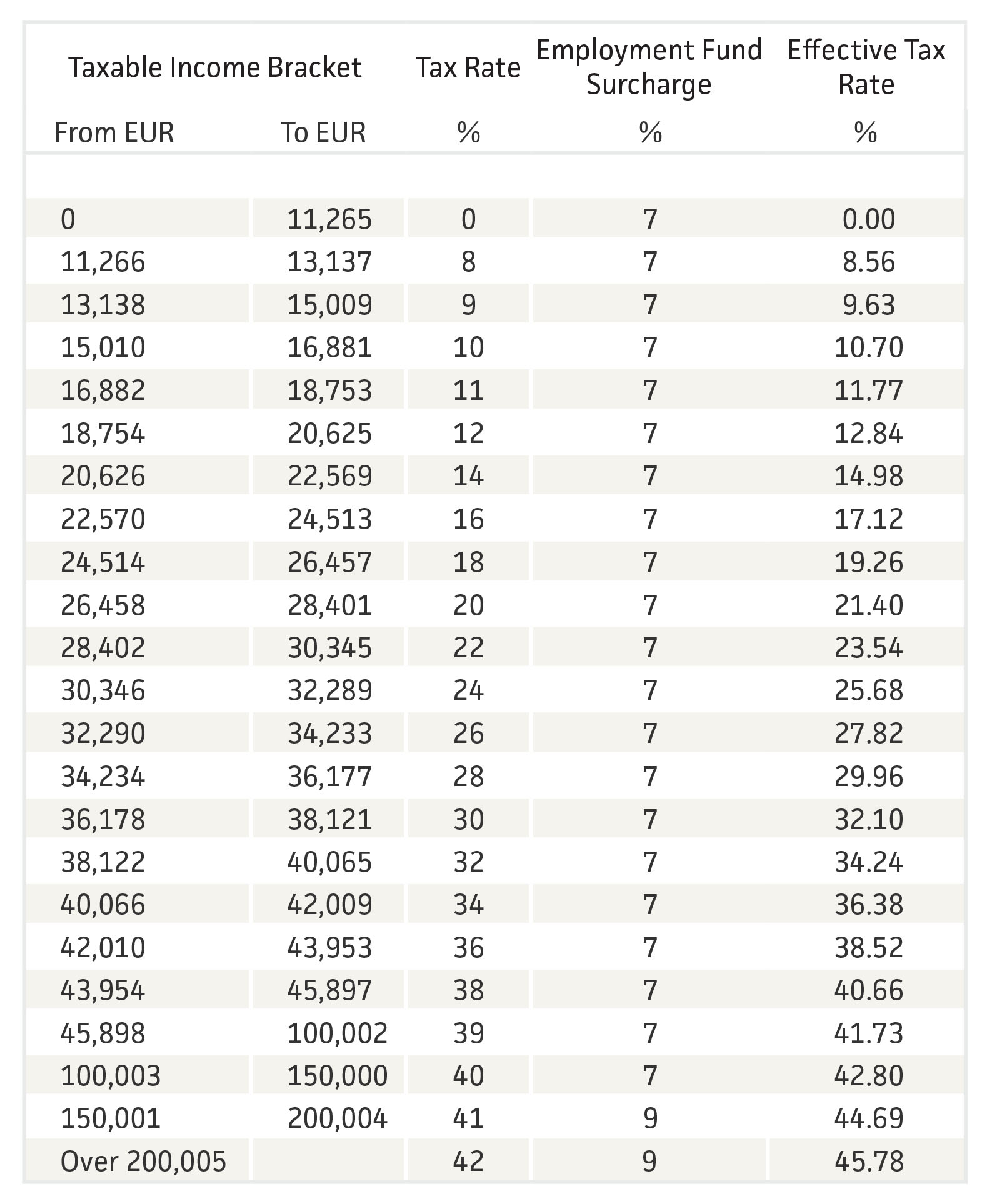

Luxembourg Tax Guide Analie Tax Accounting

Https Odc Gouvernement Lu Dam Assets Publications Rapport Etude Analyse Programme National De Reforme 2020 Pnr Luxembourg 2020 2020 Nrp Luxembourg 2020 En Pdf

Corporate Income Tax Business Guichet Lu Administrative Guide Luxembourg

Luxembourg Taxing Wages 2020 Oecd Ilibrary

Luxembourg S New Emissions Based Company Car Tax Kpmg Luxembourg